The Fast-Moving Consumer Goods (FMCG) stock market presents a dynamic and ever-evolving landscape for investors. To succeed in this industry, it's critical to grasp the underlying trends shaping consumer behavior, global economic conditions, and competitive market dynamics. Crafting a robust investment strategy that considers these elements is key for achieving long-term success.

- Essential factors to consider include:

- Purchasing trends and preferences

- Economic growth and development

- Innovation advancements impacting the FMCG sector

- Legislative changes affecting production and distribution

By meticulously evaluating these factors, investors can pinpoint promising FMCG stocks with robust growth potential.

Top FMCG Stocks for Long-Term Growth

Investing in the Fast-Moving Consumer Goods (FMCG) sector can offer substantial returns for long-term investors. The industry's consistency is driven by consistent consumer demand for essential products, making it a attractive choice amidst market fluctuations. To capitalize on this trend, consider exploring established FMCG stocks with a history of growth. A thorough assessment of financial statements, market share, and brand recognition can help identify companies poised for continued development in the years to come.

- Indicators to consider when evaluating FMCG stocks include:

- Revenue growth and profitability trends.

- Product recognition and customer loyalty.

- Strong management team.

- Reach into new markets or product categories.

Exploring the Potential of Consumer Goods Stocks

Consumer goods stocks have long been considered as a reliable and consistent investment strategy. This market encompasses a wide range of companies that manufacture products consumed by individuals on a regular basis. While consumer spending can be affected by economic cycles and consumersentiment, savvy investors can spot possibilities within this ever-changing sector.

A strong investment strategy should include a carefully chosen mix of consumer goods stocks to spread risk. Metrics such as brand performance, market share, and potential should be meticulously analyzed when making choices.

Investing in consumer goods stocks can offer investors the opportunity to engage with the growth of everyday spending. By understanding the trends and factors shaping this thriving sector, investors can structure their portfolios for long-term returns.

Is the FMCG Sector a Smart Choice?

The everyday essentials sector has consistently proven as being a reliable performer during economic fluctuations. With its bread-and-butter products, the FMCG sector tends to be more stable compared to other sectors. Buyers are targeting this sector as a potential hedge against market fluctuations.

Nonetheless, it is important to conduct due diligence before taking any investment choices. Factors such as consumer behavior can significantly impact the performance of specific brands within the FMCG sector.

Fast-Moving Consumer Goods Stocks Surge Amidst Booming Consumer Spending

As consumer confidence continues to climb, the FMCG sector is benefitting from a surge in demand. Buyers are flocking to everyday essentials, driving impressive revenue for leading companies. This trend is expected to persist in the coming months, making FMCG stocks a attractive investment choice.

- Market experts predict continued growth in the sector, fueled by factors such as increased disposable income and a growing population.

- However, investors should carefully consider potential challenges, including supply chain disruptions, which could impact profitability.

Scrutinizing Top-Performing FMCG Stocks

The fast-moving consumer goods (FMCG) sector consistently attracts the interest of investors here due to its robustness and potential for growth. To discover top performers within this dynamic market, a thorough analysis is necessary. This involves reviewing key factors such as revenue, earnings, and market share.

- Furthermore, researchers often consider the firm's financial health through metrics like the debt-to-equity ratio and the current ratio.

- Conclusively, understanding market dynamics is critical for forecasting the future performance of FMCG companies.

Via a comprehensive analysis, investors can derive understanding into the strength of top-performing FMCG stocks, ultimately informing their portfolio allocation.

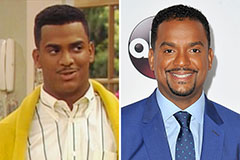

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now!